closed end loan disclosures

102636 Prohibited acts or practices and certain requirements for credit secured by a dwelling. If a closed-end consumer credit transaction is secured by real property or a cooperative unit and is not a reverse mortgage the creditor discloses a projected payments table in accordance with 102637c and 102638c as required by 102619e and f.

Regulation Z Closed End Disclosure Content for Mortgage Loans.

. Regulation Z Closed End Disclosure Content for Mortgage Loans. If disclosures are delayed until conversion and the closed-end transaction has a variable-rate feature disclosures should be based on the rate in effect at the time of conversion. Use our Closing Disclosure Explainer to review and understand the details within your disclosure before closing on your mortgage loan.

Some lenders may provide you with an initial loan worksheet which can be any type of document explaining your estimated rates terms and payments based on initial information youve provided. The Federal Reserve has published several rules implementing certain provisions of the Mortgage Disclosure Improvement Act MDIA. 102638 Content of disclosures for certain mortgage transactions Closing Disclosure.

2801 VIA FORTUNA SUITE 600 AUSTIN TX 78746 Page 1 of 2800 569-3665 WWWSMSLPCOM. The Loan Estimate is provided within three business days from application and the Closing Disclosure is provided to consumers three business days before loan consummation. Prepared by Marjorie A.

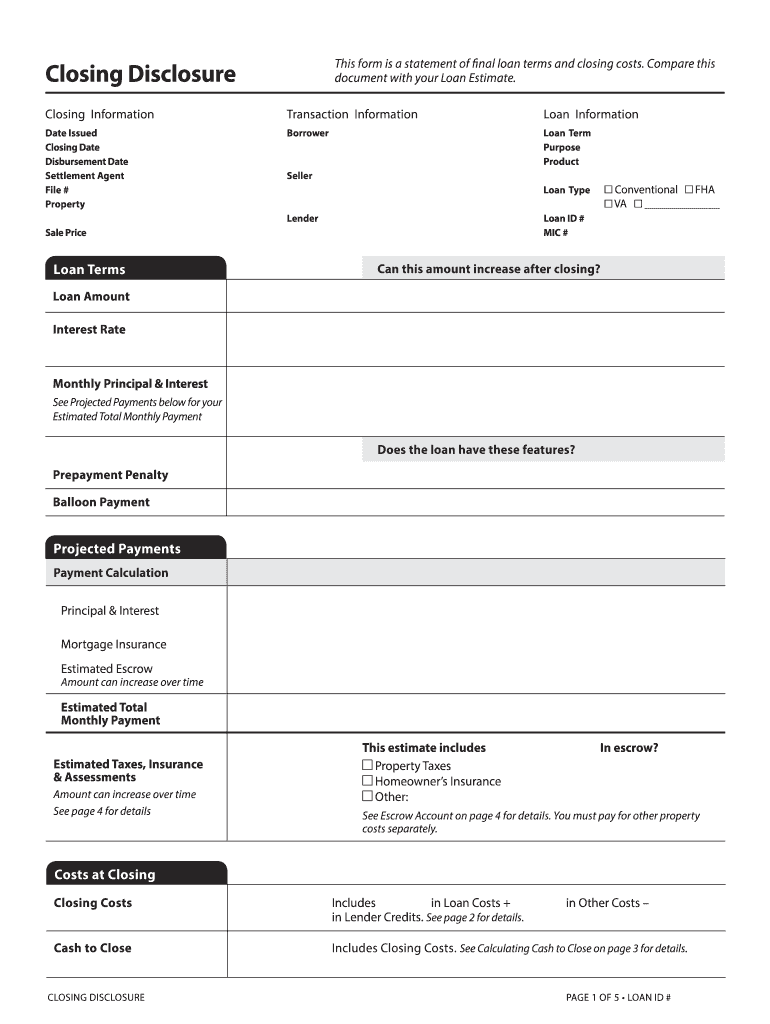

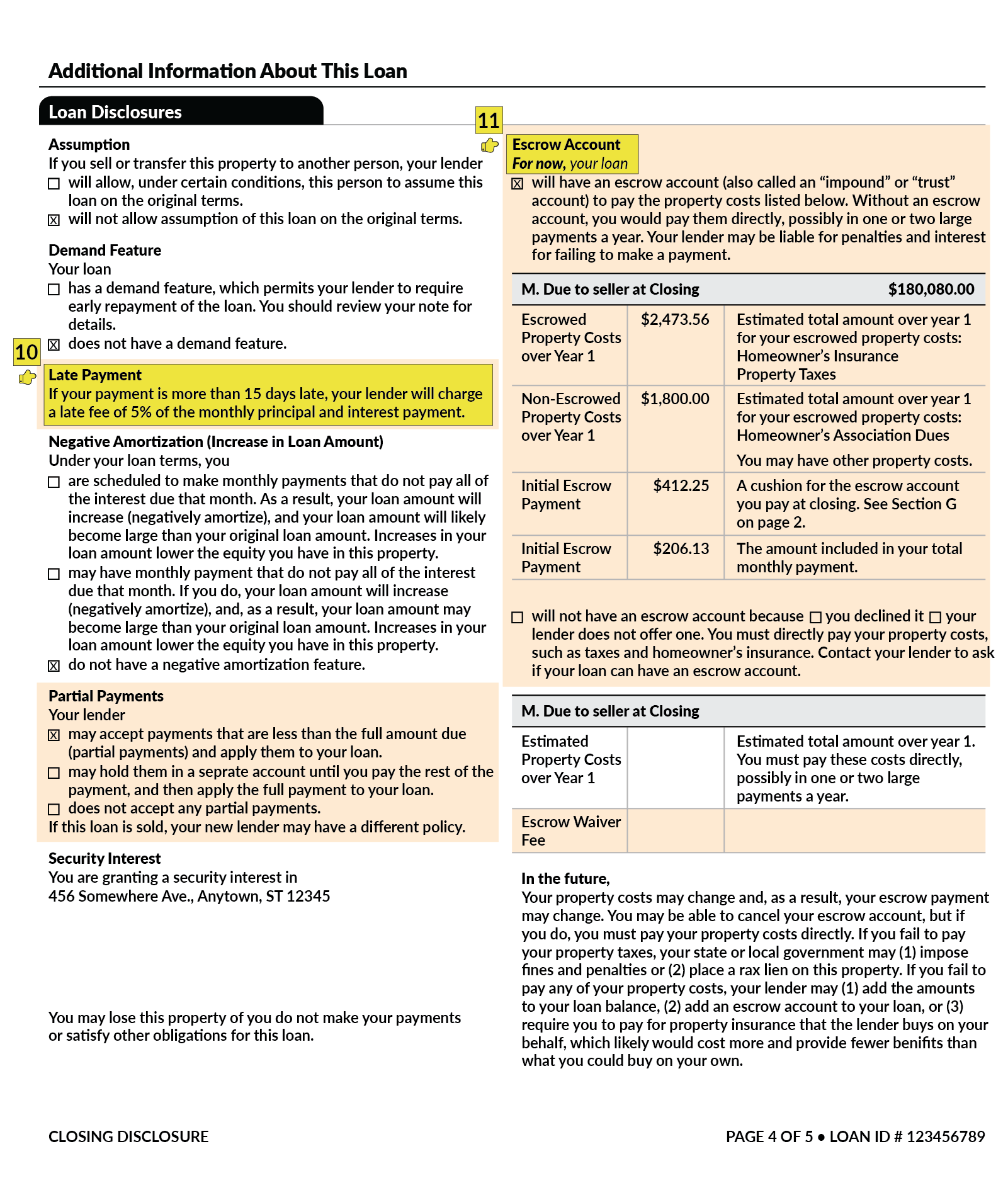

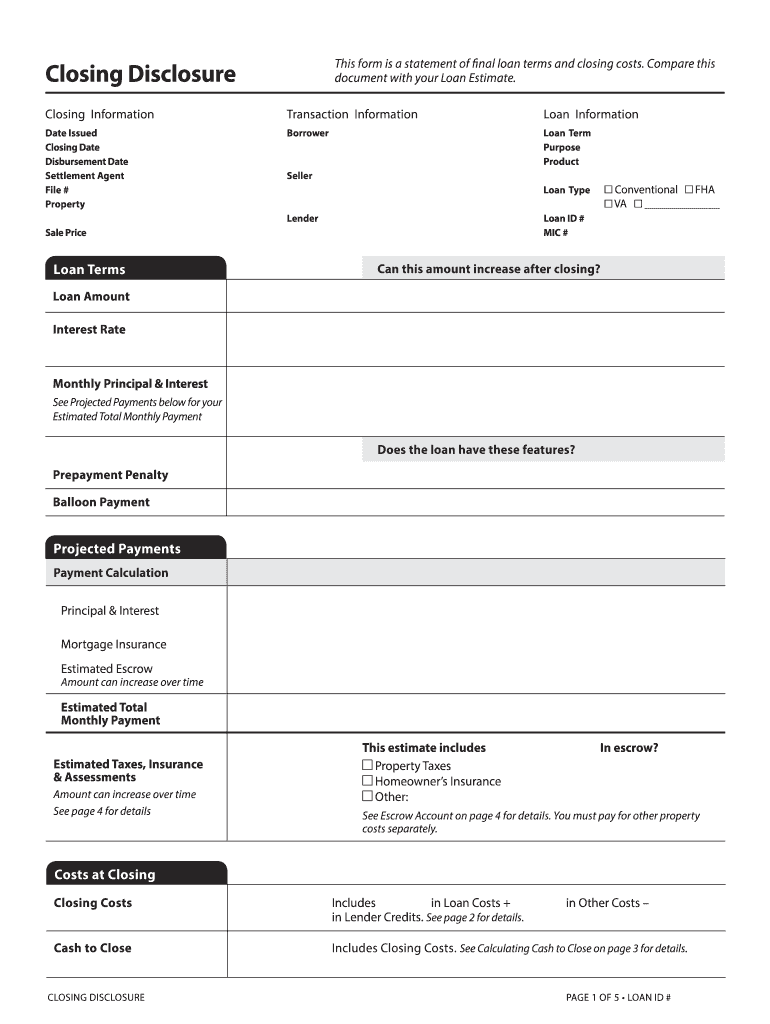

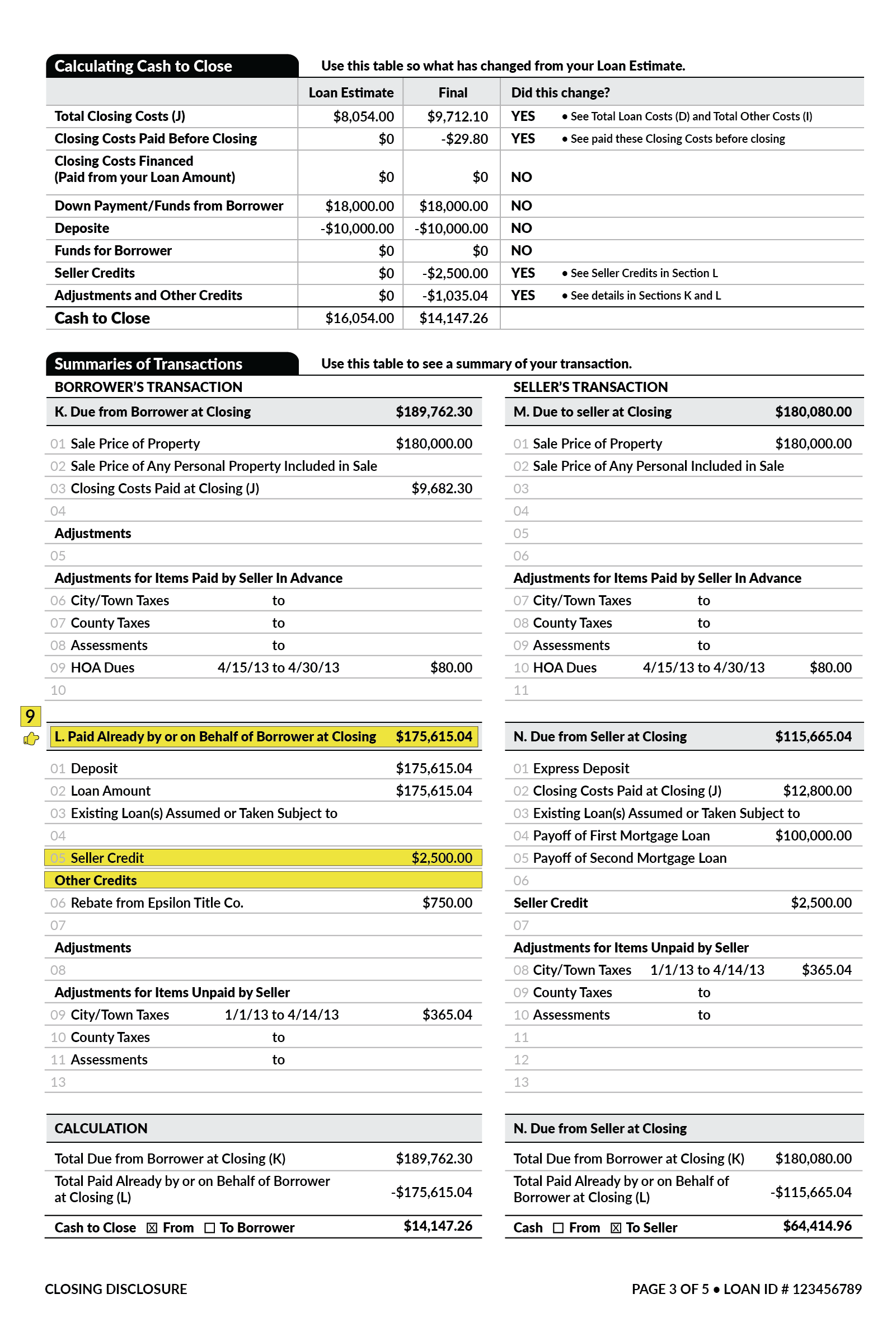

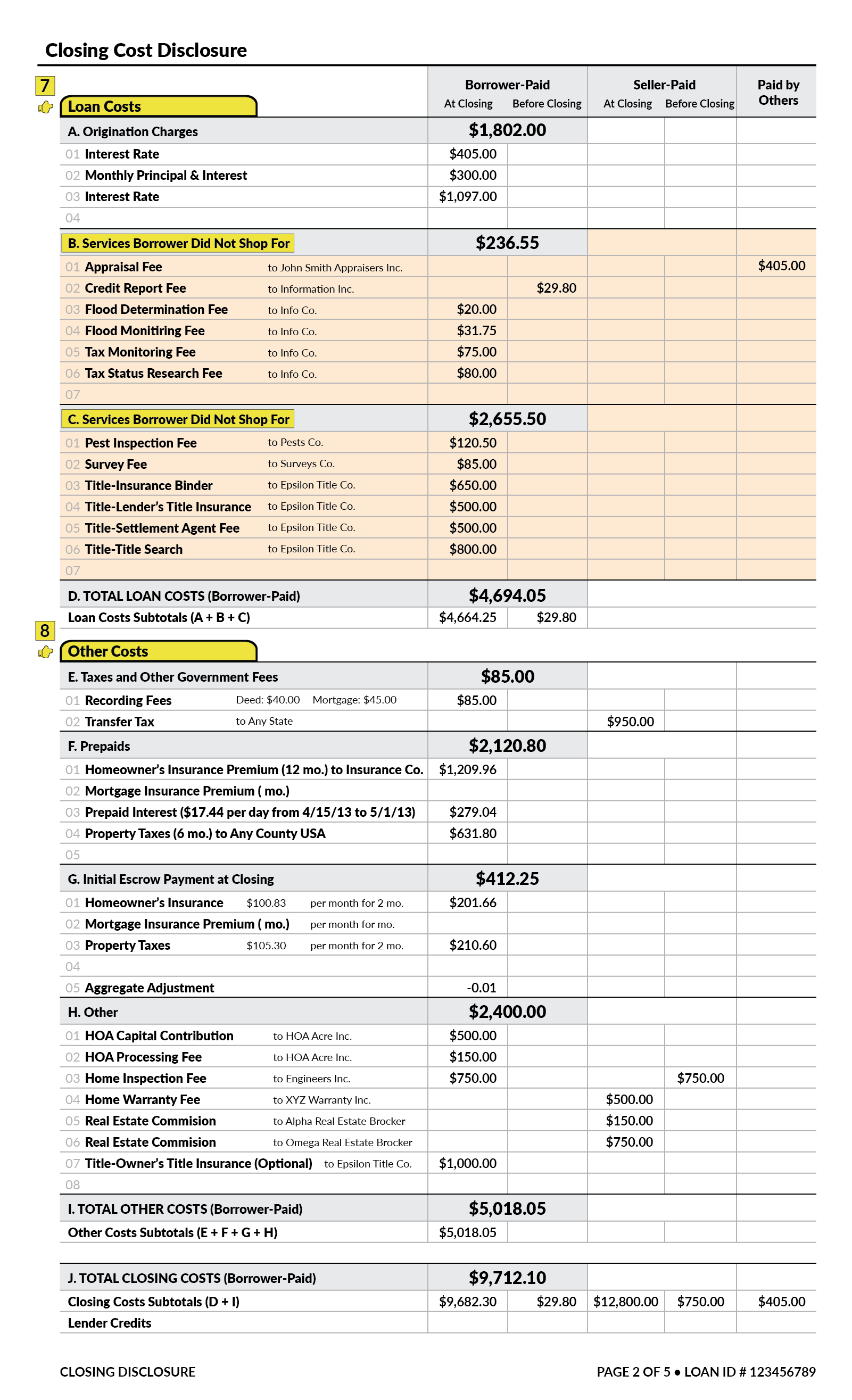

Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by. The Closing Disclosure is a five-page form that describes the critical aspects of your mortgage loan including purchase price loan fees interest rate estimated real estate taxes insurance closing costs and other expenses. Payment schedule including number amount and timing of payments.

A refinancing takes place when an existing obligation is satisfied and replaced by a new obligation for the same borrower. 102637 Content of disclosures for certain mortgage transactions Loan Estimate. Description of the security interest if applicable.

After choosing a lender and running the gantlet of the mortgage underwriting process you will receive the Closing Disclosure. Generally the only time that new Truth in Lending Act TILA disclosures are required for closed-end loans is if a refinancing occurs. 102635 Requirements for higher-priced mortgage loans.

The Loan Estimate and Closing Disclosure must be used for most closed-end consumer mortgages secured by real property or a cooperative unit. In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was established in connection with the transaction and will be cancelled the creditor or servicer shall disclose the information specified in paragraph e2 of this section in accordance with the form. For a closed-end transaction secured by real property or a dwelling other than a transaction that is subject to 102619e and the creditor shall disclose a statement that there is no guarantee the consumer can refinance the transaction to.

These disclosures must be used for mortgage loans for which the creditor or mortgage broker. Creditors providing the disclosures required by 10269c2vB of this section in person in connection with financing the purchase of goods or services may at the creditors option disclose the annual percentage rate or fee that would apply after expiration of the period on a separate page or document from the temporary rate or fee and the length of the period provided that the. Most closed -end consumer mortgage loans.

Only applies to loans for the purpose of purchasing or initial construction of and secured by the consumers principal dwelling. Home equity lines of credit reverse mortgages and mortgages secured by a mobile home or by a dwelling other than a cooperative unit that is not attached to real property ie. The Credit Union will provide closed-end disclosures that will include the following information.

It provides the same information as the Loan Estimate but in final form. A closed-end mortgage generally cannot be renegotiated repaid or refinanced until the entire mortgage has been paid offor at least. This requirement is only applicable to first.

Depends on lien position. Sample List of Closed-End Residential Mortgage Disclosures Required to be Given to Consumers at Loan Application by Maryland Mortgage Lenders and Brokers. If consummation of the closed-end transaction occurs at the same time as the consumer enters into the open-end agreement the closed-end credit disclosures may be given at the time of conversion.

Of the disclosures you list here would be the status in a closed-end home equity loan. Only applies to purchase-money loans subject to RESPA. Calculation of amount financed APR finance charge security interest charges.

For closed end dwelling-secured loans subject to RESPA does it appear early disclosures.

What Is A Closing Disclosure Lendingtree

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Fraud Prevention Tip Talk To Someone Before You Give Up Your Money Or Personal Information Talk To Someone You Trus You Gave Up Credit Union Company Culture

Closing Disclosure Form Fill Online Printable Fillable Blank Pdffiller

What Is A Closing Disclosure Lendingtree

Open End Home Equity Lending Reverse Mortgage Home Equity Mortgage Rates

Infographic The Loan Process Simplified Werk

Home Equity Oak Tree Business Refinancing Mortgage Home Equity Mortgage Loan Officer

Home Oak Tree Business Systems Business Systems Credit Union Business

Make A Financial Recovery Kit To Rally Faster After Disaster Credit Union Disasters Financial

Home Equity Oak Tree Business Home Equity Equity Credit Union

Pin On Consumer Lending Forms For Credit Unions

Understanding Finance Charges For Closed End Credit

Sign The Closing Disclosure Cd Mortgagemark Com

What Is A Closing Disclosure Lendingtree

What Is A Closing Disclosure Lendingtree

About The Tila Respa Integrated Closing Disclosure Nfm Lending Payroll Records Payroll Software

Closed End Home Equity Application Credit Union Form Http Www Oaktreebiz Com Products Services Closed End Home Equi Home Equity Home Equity Loan Credit Union

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)

:max_bytes(150000):strip_icc()/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)